Let’s talk about something you might not check nearly as often as your bank account – and that’s how much your home is worth. But when it comes to your financial situation, it’s an important thing to remember. When’s the last time you had a professional show you the value of your home?

Think about it. For most people, your house is probably the biggest asset you have. And if you’ve owned your home for a few years (or longer), chances are it’s been quietly building wealth for you in the background. And honestly? You might be surprised by just how much.

This wealth you may not even realize you have comes in the form of home equity. Home equity is the difference between what your house is worth and what you still owe on your mortgage. It grows over time as home values rise and as you pay down your mortgage each month. Here’s an example to help you really understand how this works.

Let’s say your house is now worth $500,000, and you have $200,000 left to pay off on your loan. That means you have $300,000 in equity. And most homeowners are sitting on some pretty significant equity right now.

According to Cotality (formerly CoreLogic), the average homeowner with a mortgage has about $311,000 in equity.

Here are the two main reasons homeowners like you have record amounts of equity right now:

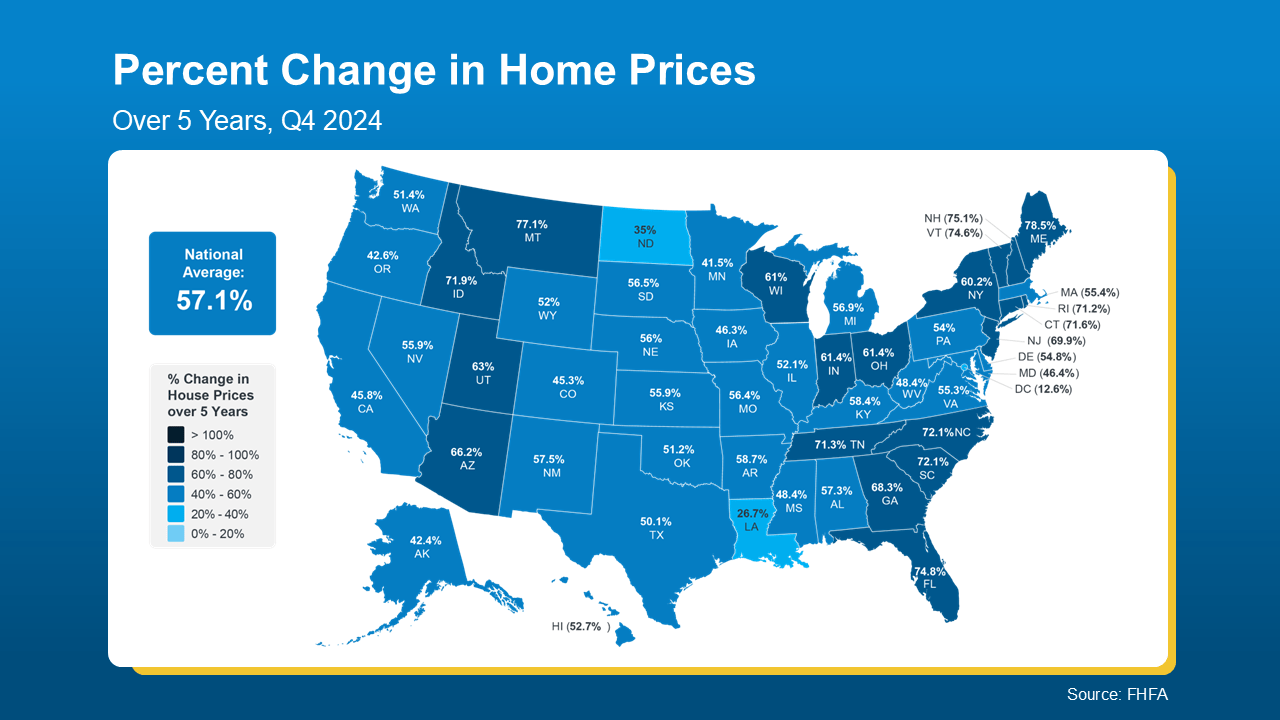

1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA), home prices have jumped by more than 57% nationwide over the last five years (see map below):

And if you purchased your home a few years ago (or more), this means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed lately.

And if you purchased your home a few years ago (or more), this means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed lately.

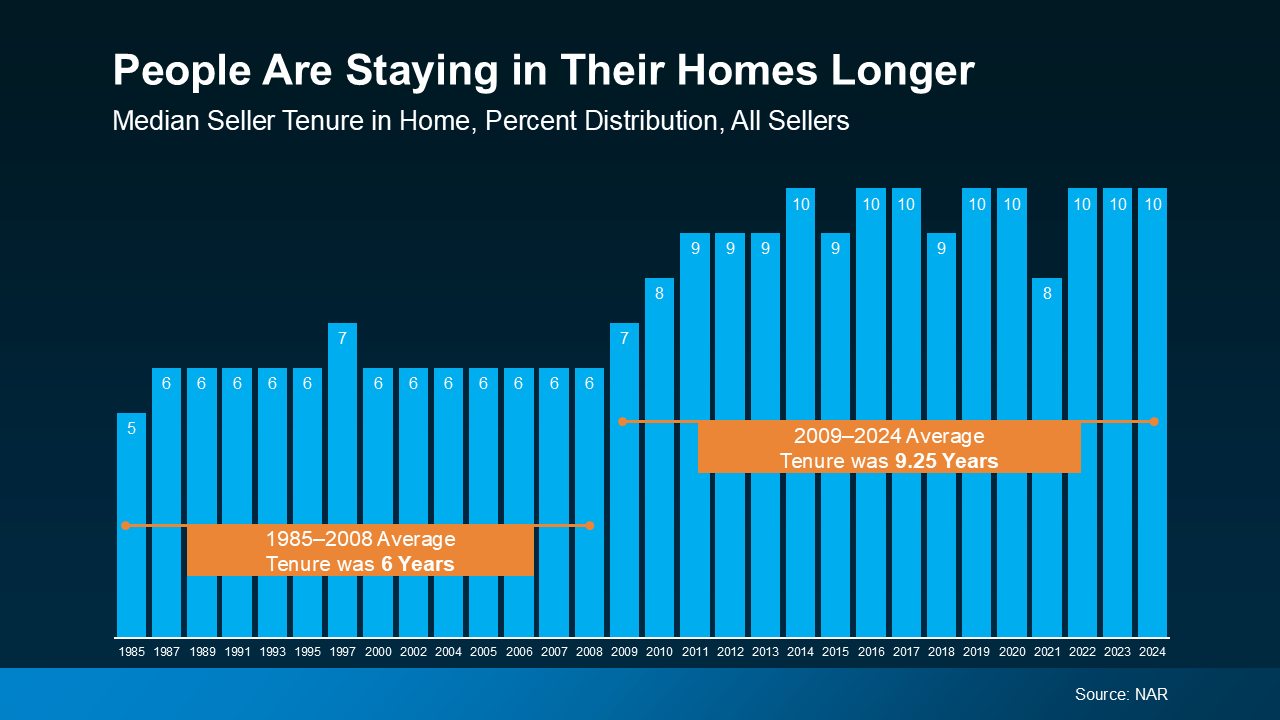

2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below):

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values.

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values.

So, if you’re one of those people who’s been in their home for that long, here’s how much the behind-the-scenes price growth has helped you out. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

Remember, your house might be your biggest financial asset – and, if you’re smart about how you leverage your equity, it could open up some exciting opportunities for your future.

Chances are, your house is worth a lot more than you realize. Whether you’re thinking about selling, upgrading, or simply want to understand your options, your equity isn’t just a number. It’s a tool.

If you sold your house and had significant equity to work with, what would you do with it? Connect with an agent to figure out how to turn your home’s value into your next big move.

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.

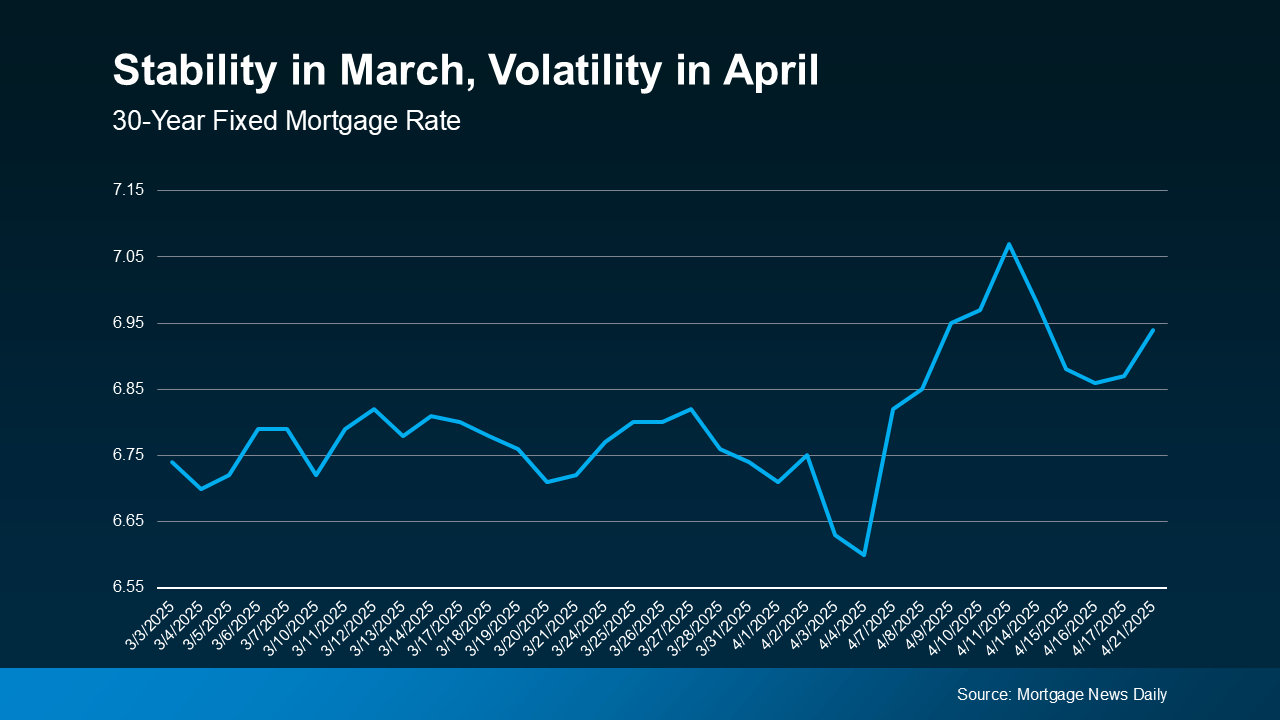

Take a look at the graph below. It uses data from Mortgage News Daily to show that after a relatively stable month of March, mortgage rates have been on a bit of a roller coaster ride in April:

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.

And that’s one of the reasons why trying to time the market isn’t your best move. You can’t control what happens with mortgage rates. But you’re not powerless. Even with all the economic uncertainty right now, there are things you can do.

You can control your credit score, loan type, and loan term. That way, you can get the best rate possible in today’s market.

Your credit score can really affect the mortgage rate you qualify for. Even a small change in your score can make a big difference in your monthly payment. Like Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Keeping your credit score up is key when it comes to qualifying for a home loan. If you’re not sure where your score stands or how to improve it, talk to a loan officer you trust.

There are also different types of loans out there, and each one comes with unique requirements for qualified buyers. The Consumer Financial Protection Bureau (CFPB) explains:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Always work with a mortgage professional to figure out which loan makes the most sense for you and your financial situation.

Just like there are different loan types, there are also different loan terms. Freddie Mac puts it like this:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most lenders typically offer 15, 20, or 30-year conventional loans. Be sure to ask your loan officer what’s best for you.

You can’t control what’s happening with the economy or mortgage rates, but you can take steps that’ll help you get the best rate possible.

Connect with a local real estate agent and a lender to talk about what you can do today to put yourself in a strong spot for when you’re ready to buy a home.

According to Realtor.com, the best week to list your house this year was April 13–19. And since that week has come and gone, you might be wondering: did I miss my chance? Not at all – and here’s why.

That’s just one source’s take, based on their own research. Other organizations run similar studies. And since different places use different methodologies for their research, sometimes the results vary too – and that’s actually good news for you. According to Zillow, the best time to list your house is still ahead.

The latest research from Zillow says sellers who list their homes in late May tend to see higher sale prices based on home sales from last year. The study explains why:

“Search activity typically peaks before Memorial Day, as shoppers get serious about house hunting before their summer vacation and the new school year in the fall. By targeting late spring, sellers can get their home listed when the most shoppers are looking. When more buyers are competing for homes, sellers can command a higher price.”

And they’re not the only ones saying selling in May can help homeowners net top dollar. ATTOM Data conducted a similar study by analyzing 59 million home sales over the past 13 years:

“Freshly compiled sales statistics from ATTOM demonstrate that home sellers continue to reap significant benefits from listing their properties during the month of May. Examination of home sales trends spanning thirteen years reveals that, on average, sellers are commanding 11.1 percent premium above the estimated market value.”

An article from Bankrate echoes this sentiment and brings this all together to show that any time in April or May is a good time:

“Some patterns and trends usually do hold true throughout the year, and one is that spring continues to be the best time to sell. Sellers can net thousands of dollars more if they sell during the peak months of April and May. . .”

The window to sell during prime time is very much still open, so you can make a move and potentially cash in big if you sell now.

That said, the best week to list your house really depends on a few local factors, like buyer demand, how many homes are for sale nearby, and how quickly things are selling. That’s why working with an experienced agent who knows your area is key.

Spring is the busiest time in real estate – and there’s still time to take full advantage of that momentum.

What’s holding you back from making your move this spring? And what would help you feel ready? Connect with an agent to talk about it.

If buying a home is on your radar – even if it’s more of a someday plan than a right now plan – getting pre-approved early is still one of the smartest moves you can make. Why? Because, like anything in life, the right prep work makes things clearer.

The best time to get serious about buying is before you’re ready to buy. Here’s why.

One of the biggest benefits of pre-approval is how it helps you understand your buying power. As part of the pre-approval process, a lender will walk through your finances and tell you what you can borrow based on your income, debts, credit score, and more. That number is power.

Once you have that clarity, you’re no longer guessing. You know what you’re working with. And that gives you the information you need to be able to plan ahead. That way, you’re not falling in love with homes that are outside of your price range – or missing out on ones that aren’t.

You don’t have to be ready to buy to be ready to buy.

It happens all the time – someone scrolls through listings just for fun, and then BAM – they fall in love with something they see online. But by the time they scramble to connect with an agent and then get pre-approved with a lender, someone else beats them to it, and they lose the home. And you don’t want that to happen to you.

While you can’t control when the right home shows up – you can be ready for it.

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time. As Experian explains:

“Waiting too long to get a preapproval, however, could leave you at a disadvantage . . . you could find the perfect home, but another buyer could snatch it up while you're waiting for the lender to review your preapproval application. . . getting a preapproval just before you begin actively looking at homes may be your best option.”

Instead of rushing to figure out your numbers, trying to get documentation for your home loan together, and watching the house you love slip away while you wait to hear from your lender, you’re already in the game.

It’s like showing up to the starting line with your shoes tied and your warm-up done – while everyone else is still looking for parking.

But pre-approvals do have an expiration date, so be sure to ask your lender how long it’s good for. Bankrate offers this insight:

“Many mortgage preapprovals are valid for 90 days, though some lenders will only authorize a 30- or 60-day preapproval. If your preapproval expires, getting it renewed can be as simple as your lender rechecking your credit and finances to ensure there have been no major changes to your situation since the first time ‘round.”

The thing is, if you’ve been pre-approved – even if you’re just thinking about casually looking – you have a much better sense of how to navigate your home search within your budget. Plus, you’ll be ready if the perfect home comes along. So why not make it happen?

Getting pre-approved doesn’t mean you have to buy a house today. But it does mean you’ll know what you're working with when the right one shows up. If you want to get pre-approved, connect with a lender to get that process started.

In the meantime, have a conversation with an agent about what's on your mind and what you're looking for.

If the perfect house popped up tomorrow, would you be ready to make a move?

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?”

If you’ve been scrolling through social media or watching the news, you might have seen some pretty scary headlines yourself. That’s why it’s no surprise that, according to data from Clever Real Estate, 70% of Americans are worried about a housing crash in 2025.

But before you hit pause on your plans to buy or sell a home, take a deep breath. The truth is: the housing market isn’t about to crash – it’s just shifting. And that shift actually works in your favor.

Mark Fleming, Chief Economist at First American, says:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

Think about it. If there’s a shortage of something – like tickets to a popular concert – prices go up. That’s what’s been happening with homes. We still have a shortage of supply. Too many buyers and not enough homes push prices higher.

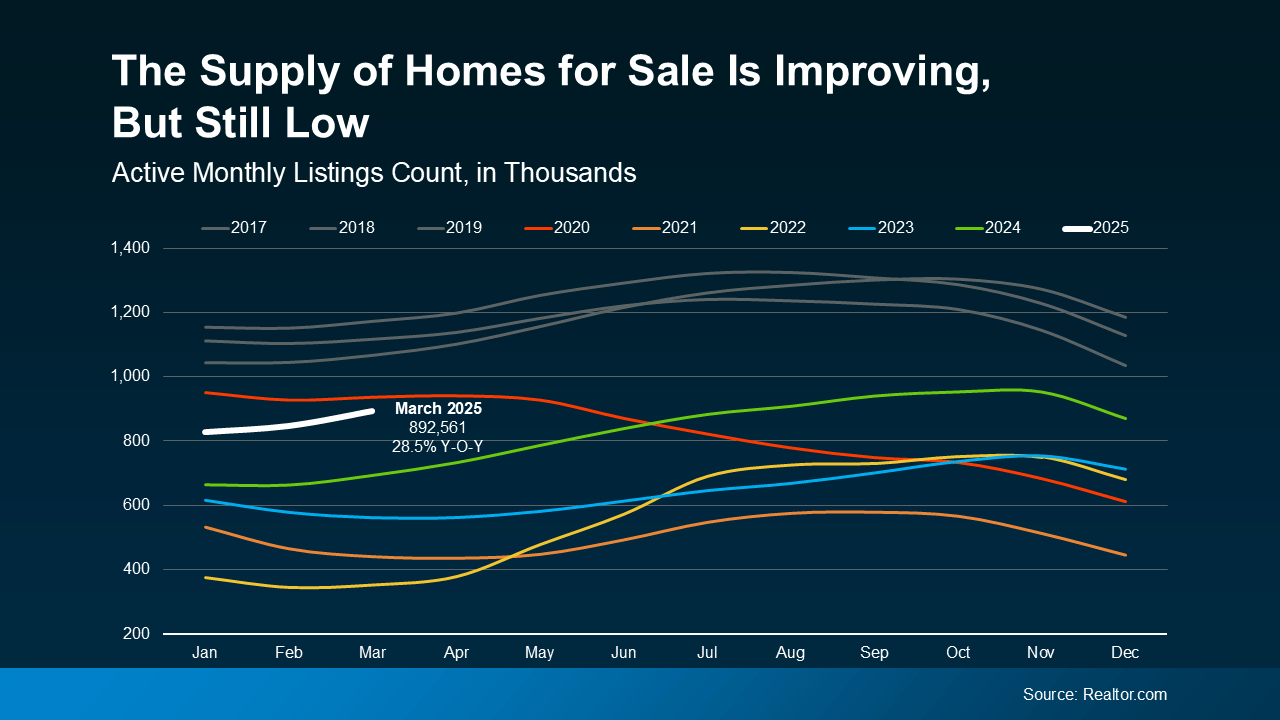

Check out the white line for 2025 in the graph below. Even though the number of homes for sale is climbing, data from Realtor.com shows we’re still well below normal levels (shown in gray):

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

And, as more homes become available, that takes some of the intense upward pressure off home price growth – leading to healthier price appreciation.

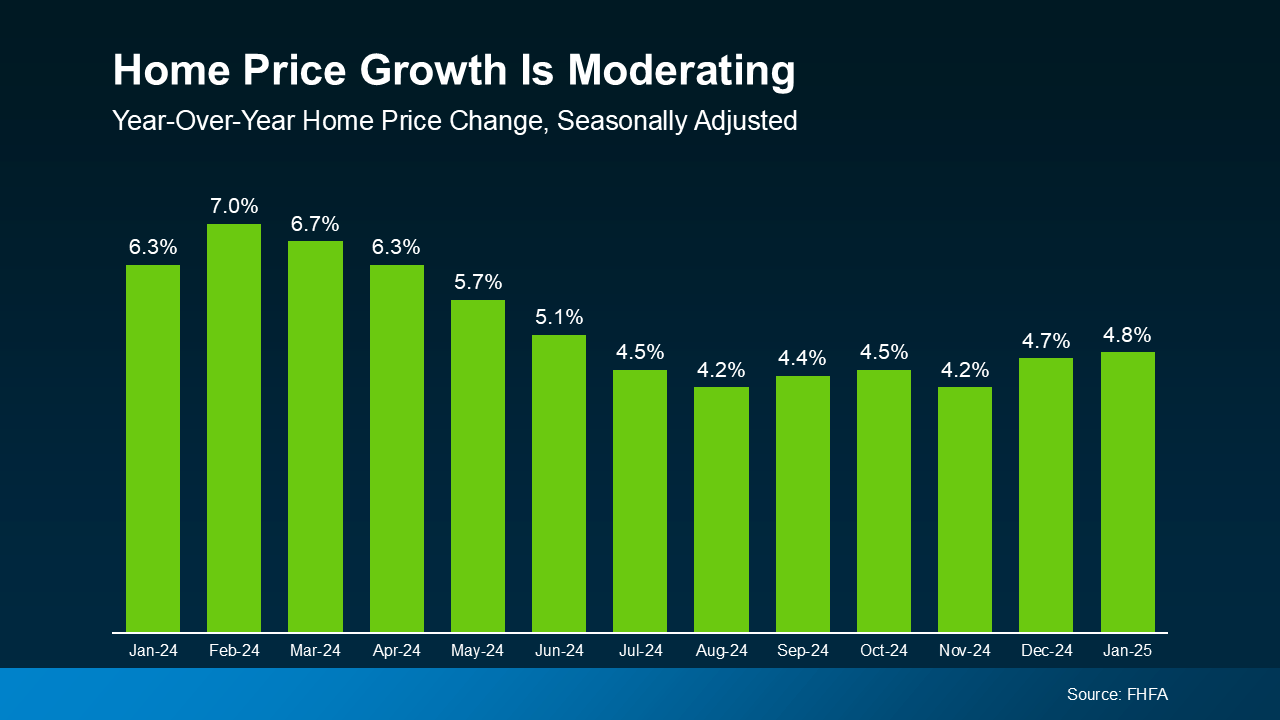

So, while prices aren’t falling nationally, growing inventory means they also aren’t rising as fast as they were. What we’re seeing is price moderation (see graph below):

And according to Freddie Mac, that moderation should continue through the rest of this year:

And according to Freddie Mac, that moderation should continue through the rest of this year:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Put simply, that means prices will continue going up in most areas, just not as quickly. That’s good news for anyone who’s been having trouble finding a home and feeling sticker shock from the rapid price appreciation of the past few years.

But of course, what’s happening with prices and inventory is going to vary by local market. So, talk to your agent to find out what’s happening where you live.

Don’t let the talk scare you. Experts agree that a housing market crash is unlikely in 2025. As Business Insider reports:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

Instead, we’re heading into a housing market that’s healthier and more balanced, with slower price growth and more opportunity.

Chat with a local real estate agent about what’s happening in your local market and how you can make the most of it.

You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So, if you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home, like the down payment and closing costs. And here’s the best part.

On average, people are getting even more money back in their refunds than they did last year. While it’s not a big increase, the visual below uses data from the Internal Revenue Service (IRS) to show the average individual’s refund is 3.9% higher this year:

Of course, how much money you may get in your tax refund is going to vary. But when it comes to buying a home, any extra cash can help move things forward. Here are a few examples of how you can put that money to good use, according to Freddie Mac:

But you don’t have to figure it all out on your own. Working with a team of trusted real estate professionals who understand the homebuying process, what you need to save, and any resources you can tap into will help you make sure you’re ready to buy when the time comes.

When it comes to saving for a home, every dollar gets you one step closer to your goal. While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost.

What would having your own home mean for you or your family this year?

Now that spring is here, more and more buyers are jumping back into the market, and competition is heating up.

If you’re serious about landing a home you’ll love, you need more than just a wish list. You need a smart strategy – and that starts with working with a great agent who can help you put together a strong offer.

Here are some top tips your agent will share with you that are helping buyers stand out (and win) in today’s market.

It’s tempting to start with a super low offer in an attempt to save money. But in a competitive spring market, that could backfire. If the price isn’t reasonable, you could offend the seller and lose out to a better bid. As NerdWallet says:

“If you really want the property, you should avoid offending the seller. So, be wary of placing a so-called lowball offer. One of the most obvious risks of making a lowball offer is outright rejection. . . As a buyer, you’ll need to find a balance between making a fair offer and running the risk of losing the property.”

Your agent can help you understand local pricing trends and what a fair, yet strong offer looks like this season.

If you’re worried about competing bids, an escalation clause can help. If you have an escalation clause and the seller gets another offer, it increases yours up to a certain max amount you set. That way you don’t lose out over a small difference. Investopedia explains it like this:

“An escalation clause is a way to automatically escalate your bid by a certain dollar amount, up to a certain ceiling, to compete with other bids.”

Work with your agent to decide if this tactic fits your situation and budget. Just be sure not to stretch beyond what you’re truly comfortable spending and that the home is likely to appraise for the amount you offer.

If the appraisal comes in lower than your offer, you may have to make up the difference out of pocket. Your agent can help you weigh these risks and determine the best approach for your specific situation.

While some concessions (like help with closing costs) might be possible, too many demands could make another buyer’s cleaner offer more attractive. As the National Association of Realtors (NAR) notes:

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

An agent who knows what’s working for other buyers in your area can help you prioritize the most important asks – and avoid ones that could turn off the seller.

Sometimes, it’s not just about price, it’s about timing. Does the seller need extra time to move out? Or do they want to move as soon as possible? Flexibility here can work in your favor. By adjusting your timeline (if you’re able to), you could stand out against other offers. According to Atlas Van Lines:

“Everyone will have a unique timeline depending on the size of the move, the distance they are moving from or to, and personal preferences. It is important to be flexible and adapt the timeline as needed while ensuring you allocate enough time for each step.”

Your agent can communicate with the seller’s agent to find out what matters most, including timing.

Spring is here – and more buyers are entering the market. Work together with a local real estate agent to make sure your offer stands out.

What’s one thing you want to feel confident about before making an offer this spring?

When you finally find the home you want to buy, it’s easy to get caught up in the excitement. You’ve toured the place, imagined your furniture in it, maybe even pictured your morning coffee on the porch. The last thing you want is to slow down the process with more steps or lose out to another buyer’s offer because they skipped their inspection.

But here’s the thing. Buying a home is one of the biggest financial decisions you’ll ever make. And no matter how perfect that house seems, skipping a home inspection is a risk that could cost you a lot more than just time.

A home inspection gives you a detailed look at the home’s condition, usually after your offer’s accepted but before closing. While what’s covered varies by state, an inspector usually goes over the home’s major systems and structure, including things like the roof, foundation, plumbing, electrical, HVAC, and more.

Here’s a quick rundown of some of the biggest benefits of getting an inspection.

A few hundred dollars upfront for the home inspection could save you thousands in surprise repairs later. As the National Association of Realtors (NAR) says:

“Failure to obtain a home inspection could potentially cost you a great deal of money and hassles in the long run.”

According to the latest data from NAR, nearly 1 in 4 buyers are waiving (or removing) the inspection contingency when they buy a home. And with spring being peak homebuying season and buyer activity already heating up, you may be thinking about doing that yourself. As Realtor.com points out:

“ . . . if you're in a hot real estate market where homes are getting multiple offers, there might be a temptation to skip an inspection when you really want the house. However, waiving a home inspection comes with sizable risks.”

But skipping the inspection is a gamble that doesn’t necessarily pay off. Just remember, there are other ways to make your offer attractive to sellers, like being flexible with the closing date. Before making an offer, talk to your agent about other ways to get a seller’s attention without sacrificing your peace of mind.

Even if skipping an inspection sounds like a way to make your offer more competitive or speed things up, it’s risky. It’s not just extra time and documentation, it’s a smart step that protects your wallet, your investment, and your future.

If you could ask a home inspector one question before buying, what would it be? Let your agent know so it’s the first thing they bring up when the time comes.