You may have heard there are more homes for sale right now. And while that’ll vary depending on the market, it means that overall, things are starting to lean in a more balanced direction. As that happens, some sellers are a bit more open to compromise. Here’s what that means for you.

You may be regaining some negotiating power. That can translate into savings, perks, or even better terms on your purchase – if you know what levers to pull during negotiation.

The complicated part is knowing what is and isn’t on the table. That’s where your agent comes in. According to the National Association of Realtors (NAR), besides finding the right home, the top thing buyers want from their agent is help negotiating the terms of the sale, followed by negotiating the price.

Here’s why. Agents are skilled negotiators and are trained for moments like this. Since your agent is an expert on the local market, they’ll also know what’s working for other buyers (and what’s not), and that can help you get a better understanding of what’s realistic to ask for.

Here are some of the most common concessions an agent can help you negotiate:

Of course, negotiating is a complex process. And not every seller will be willing to offer concessions. Again, lean on your agent for expert advice about what’s realistic to ask for and what could turn sellers off.

Because once you’ve found a home you love, you don’t want to risk losing it. But you also want to get the best terms possible on your purchase – and that’s where an agent can make all the difference.

As inventory grows, buyers are finding they have a bit more leverage. And having the right agent by your side – who can help you approach negotiations strategically – is key.

What’s your biggest concern when it comes to negotiating with a seller?

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want to put yourself in the best position to buy, there’s one step you can’t afford to skip, and that’s getting pre-approved for a mortgage.

Some buyers think they can wait until they’ve found a home they love before talking to a lender. But in a season where homes can sell fast, that’s a risky move. Getting pre-approved before you start your search is a much better bet.

Here’s what you need to know about this early step in the buying process.

Pre-approval gives you a sense of how much a lender is willing to let you borrow for your home loan. To determine that number, a lender starts by looking at your financial history. Here are some of the things that can have an impact, according to Yahoo Finance:

After their review, you’ll get a pre-approval letter showing what you can borrow. Having this peace of mind is a big deal – it helps you feel a lot more confident in your ability to get a home loan. And the fringe benefit is it can also speed up the road to closing day because the lender will already have a lot of your information.

Spring is a competitive season, and emotions can run high if you find yourself up against other buyers. Having a firm budget in mind is so important. You don’t want to get too attached and end up maxing out what you can borrow. As Freddie Mac explains:

“Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

So, use this time to really buckle down on your numbers. And be sure to factor in other homeownership costs – like property taxes, insurance, and maybe even homeowner’s association fees – so you know what you can comfortably afford.

Then, partner with your agent to tailor your search to homes that match your budget. That way, you don’t fall in love with a house that’s out of your financial comfort zone.

Spring buyers aren’t just competing for homes. They’re competing for the seller’s attention, too. And a pre-approval letter can help you stand out by showing sellers you’ve already gone through a financial check. Zillow explains it like this:

“Having a pre-approval letter handy while you’re shopping for a home can also help you act quickly once you’ve found a home you love. The letter shows potential sellers that you’re a serious buyer who has the financial means to close on the home. In a competitive market, an offer with a pre-approval letter attached will stand out among other offers that don’t include one — increasing the chances of your offer being accepted."

That means when sellers are choosing among multiple offers, yours could rise to the top simply because you’ve already taken this step.

And here’s one final tip for you. After you receive your letter, avoid switching jobs, applying for new credit cards or other loans, co-signing for loans, or moving money in or out of your savings. That’s because any changes to your finances can affect your pre-approval status.

If you’re thinking about buying a home this spring, getting pre-approved should be your first move. It’ll help you understand your budget, show sellers you’re serious, and keep you from falling in love with a house that’s out of reach. Talk to a lender to get started.

What’s your plan to stand out in this competitive market? Connect with an agent to make sure you’re fully ready to buy.

If selling your house is on your to-do list this year, the time to start prepping is now. That’s because experts say the best week to list your house is coming up fast.

A recent Realtor.com study analyzed years of housing market trends (excluding 2020 since it was an outlier) and found that April 13–19 is expected to be the ideal window to put your house on the market this year:

“. . . we’ve identified April 13-19 as the best week to list for sellers . . . a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale.”

As the quote mentions, spring is almost always a strong season for sellers. But this particular week could give you an even bigger advantage this year. Realtor.com goes on to say what listing during this sweet spot could mean for you:

With just a few weeks left before this prime listing window, you'll need to make a plan to work smart and act fast. That’s where working with a great real estate agent comes in. They can help you:

Assuming your house is already in good shape, your focus should be on quick, high-impact updates. As Investopedia explains:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are a few examples of small projects that can make a big difference according to Redfin:

Don’t worry – it’s okay if you don’t think you’ll be ready for this week. Just because April 13–19 is projected to be the ideal week by Realtor.com, that doesn’t mean it’s the only good time to sell. Even if you need a bit more time to get your home list ready, there’s still plenty of opportunity this homebuying season.

If you’ve been waiting for the right time to sell, this could be it. But timing isn’t the only thing that matters – how well you prep and price your home is just as important.

What’s one thing you’d need to do before you’d feel ready to list? Connect with an agent to figure out the best plan to make it happen.

Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.

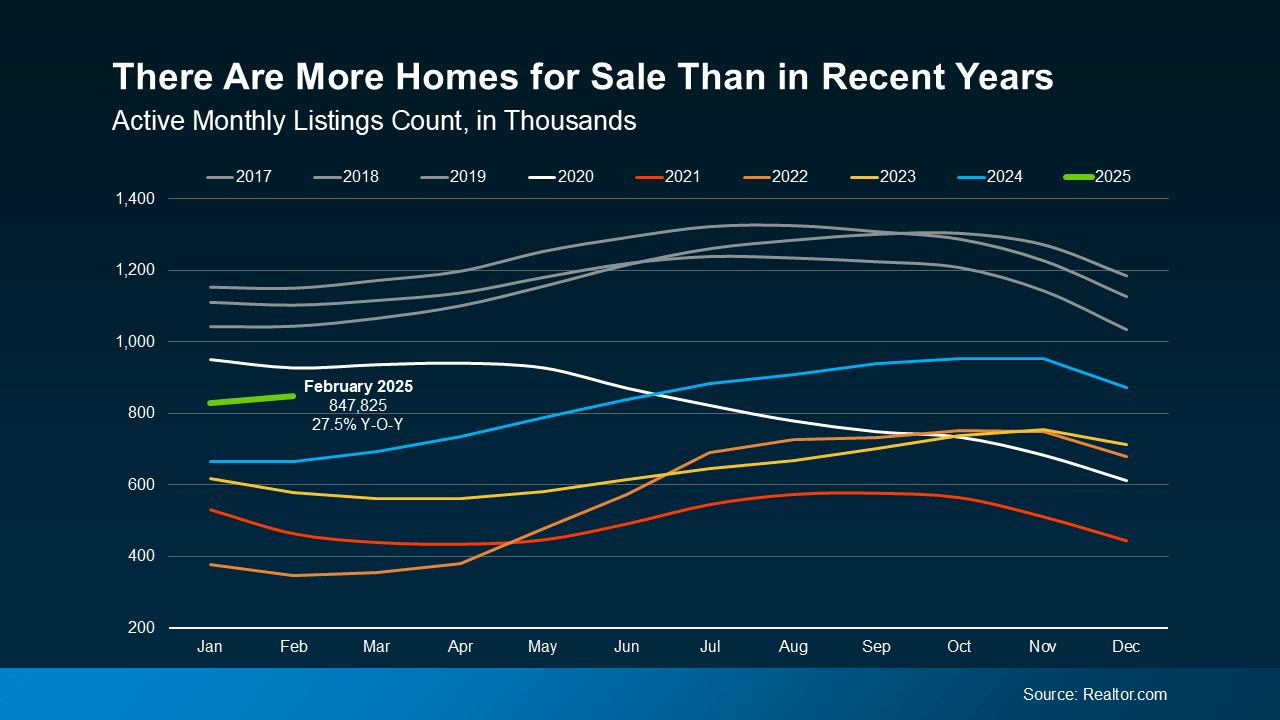

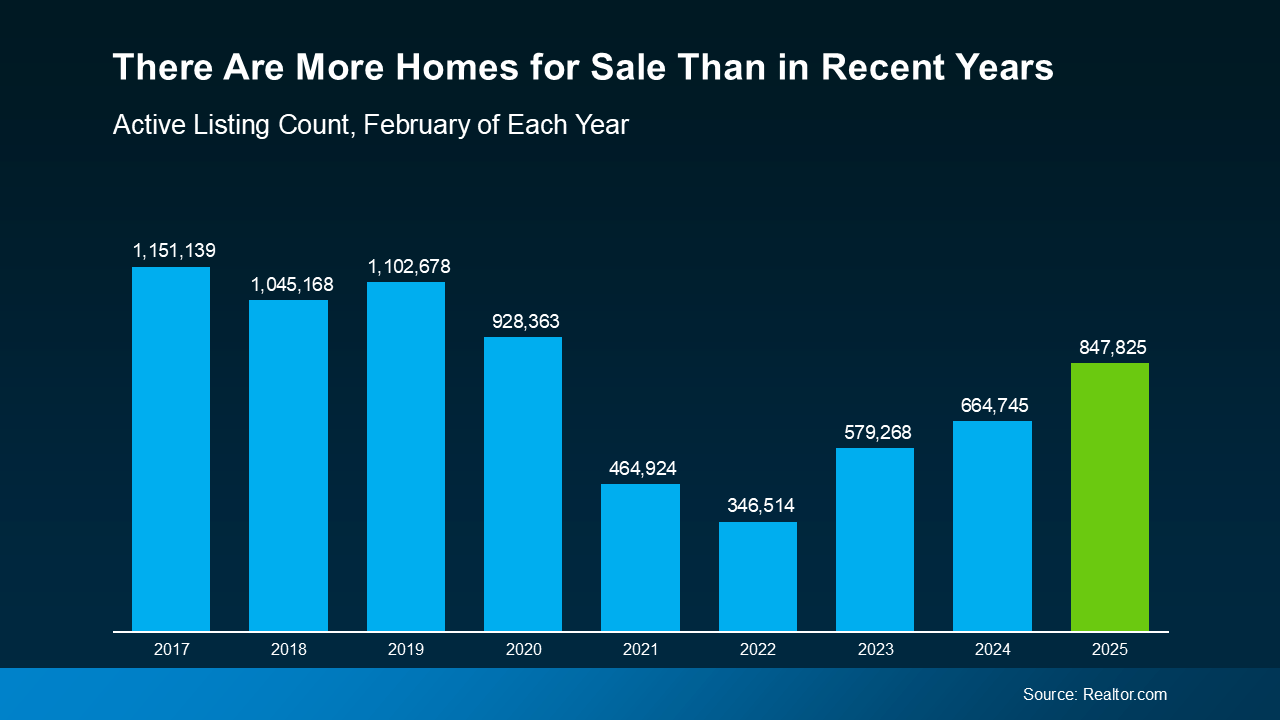

After a long stretch of tight inventory, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active listings are up 27.5% compared to this time last year.

Look at the graph below and follow the green line for 2025. You can see, even though inventory levels still haven’t returned to pre-pandemic norms (shown in gray), that number is higher than it has been going into the spring market over the past few years (see graph below):

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective.

Sellers: With more homes available than in recent years, you’re more likely to find what you’re looking for when you move. And knowing that inventory is still below more normal levels means there will be demand for your home when you sell it, too.

As inventory grows, the pace of home price growth is slowing down – and that will continue into the spring market. This is because prices are driven by supply and demand. When there are more homes for sale, buyers have more options, so there’s less competition for each house. Rising supply and less buyer competition causes price growth to slow, but it should still remain positive in most markets. As Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

And while prices aren’t dropping at the national level, every market is different. Some areas are seeing stronger price growth, while others are cooling off or even seeing some price declines.

Buyers: The slower pace of growth means prices aren’t rising as quickly as before – and that’s a relief. Any home you buy now is likely to appreciate in value over time, helping you build equity.

Sellers: While prices are still rising, you might need to adjust your expectations. Overpricing your house in a more balanced market could mean it takes longer to sell. Pricing your house competitively is going to be key to attracting offers.

One of the biggest hurdles for buyers over the past couple of years has been high, volatile mortgage rates. But there’s some good news – overall, they’ve stabilized in recent weeks – and have even declined a bit since the beginning of this year. And while that decrease hasn’t been a big drop, stabilizing mortgage rates has helped make buying a home a bit more predictable. According to Selma Hepp, Chief Economist at CoreLogic:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

Buyers: When mortgage rates are more stable, it’s easier to plan ahead because you have a better idea of what your future payment might be. But remember, rates will continue to be volatile. So, lean on your agent and your lender to make sure you know what the latest mortgage rate means for you.

Sellers: Slightly lower rates that are starting to stabilize are encouraging more buyers to move forward with their plans. That’s good for demand when you’re planning to sell your house.

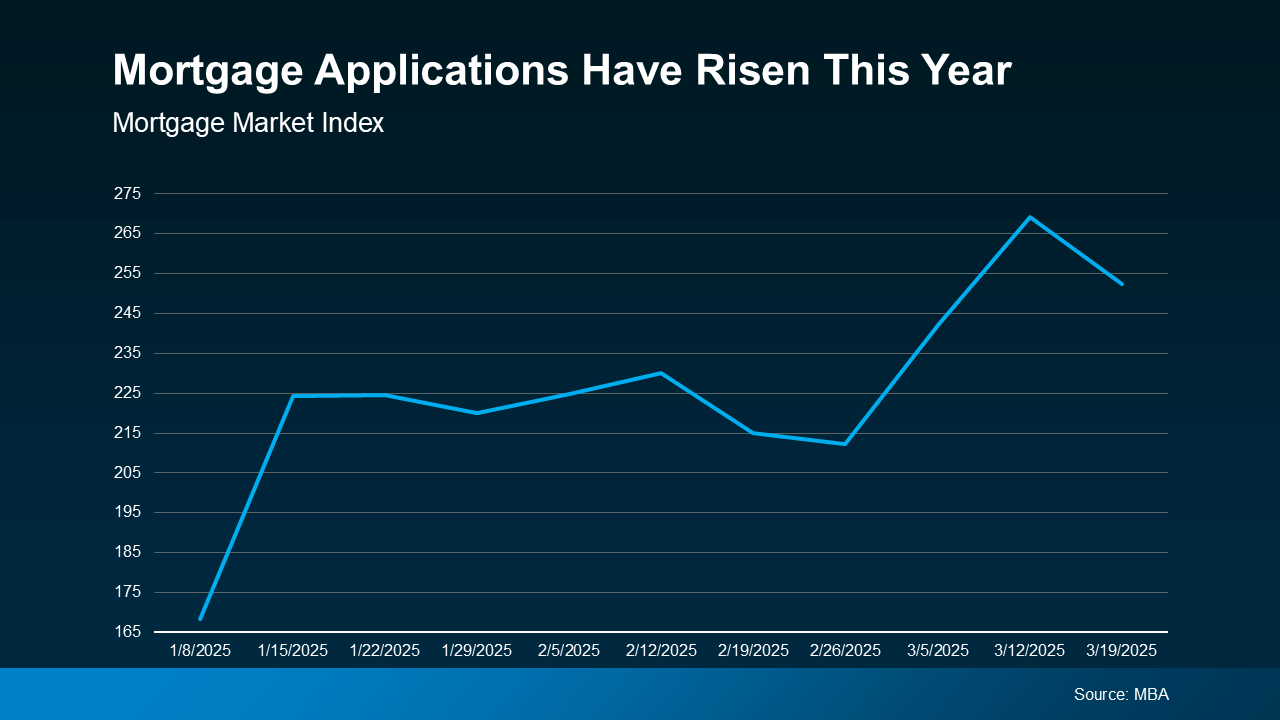

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market. Demand is picking up, and data from the Mortgage Bankers Association (MBA) shows an increase in mortgage applications compared to the start of the year (see graph below):

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Sellers: This is great news for you – more buyers mean a better chance of selling your house quickly.

Do you have questions about what the spring market means for you? Connect with a local real estate agent and talk about how to craft your plan this season.

With more homes for sale, slowing price growth, and stabilizing mortgage rates, how will this impact your decision to buy or sell this spring?

Whether you’re buying or selling a house, here’s something to think about that most people don’t. Your decision doesn’t just impact your life and your family’s, it sparks a ripple effect that has a positive impact on your entire community.

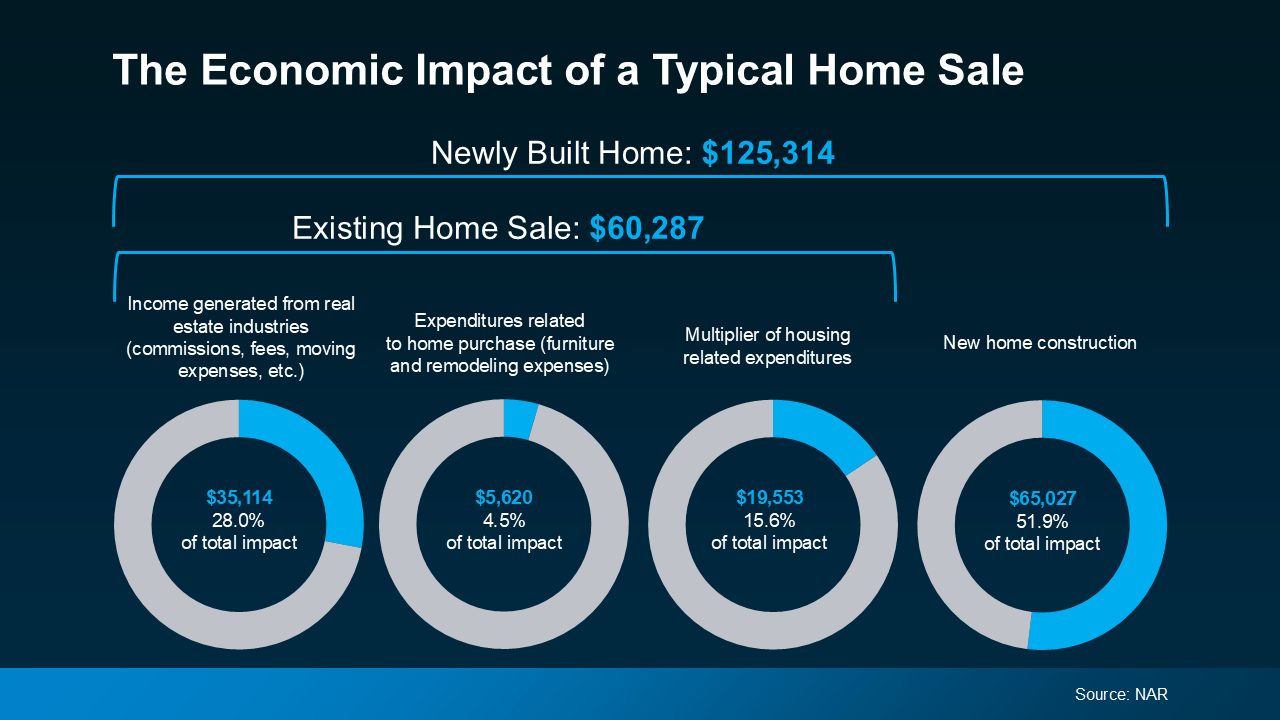

Every year, the National Association of Realtors (NAR) puts out a report that breaks down the financial impact that comes from people buying and selling homes.

The data shows that if you buy an existing (previously lived-in) home, you're giving the local economy a boost of just over $60K. And if you buy a newly built home, that number goes up to over $125K (see visual below):

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

“. . . housing is a significant job creator. In fact, for every single-family home built, enough economic activity is generated to sustain three full-time jobs for a year . . .”

When you think about it, it makes sense. Behind every home sale is a network of people involved, including contractors, city officials, real estate agents, lawyers, specialists, and more. Everyone has a job to do to help make sure your deal goes through.

Put simply, when you buy or sell a home, you’re helping out your neighbors. So, your decision to move doesn’t just meet your needs; it supports their families, strengthens your town, and shapes the future of your community.

Imagine walking through the front door of your next home, knowing your decision helped a local contractor keep their crew working or a small business thrive. Remember that feeling as you make your decision this year.

Moving isn’t just a personal milestone – it's an investment in your community, too. If you’re ready to make a move, connect with a local real estate agent. You’ll make a difference for more people than you know.

What’s most important to you as you prepare to buy or sell your house this year?

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it's a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

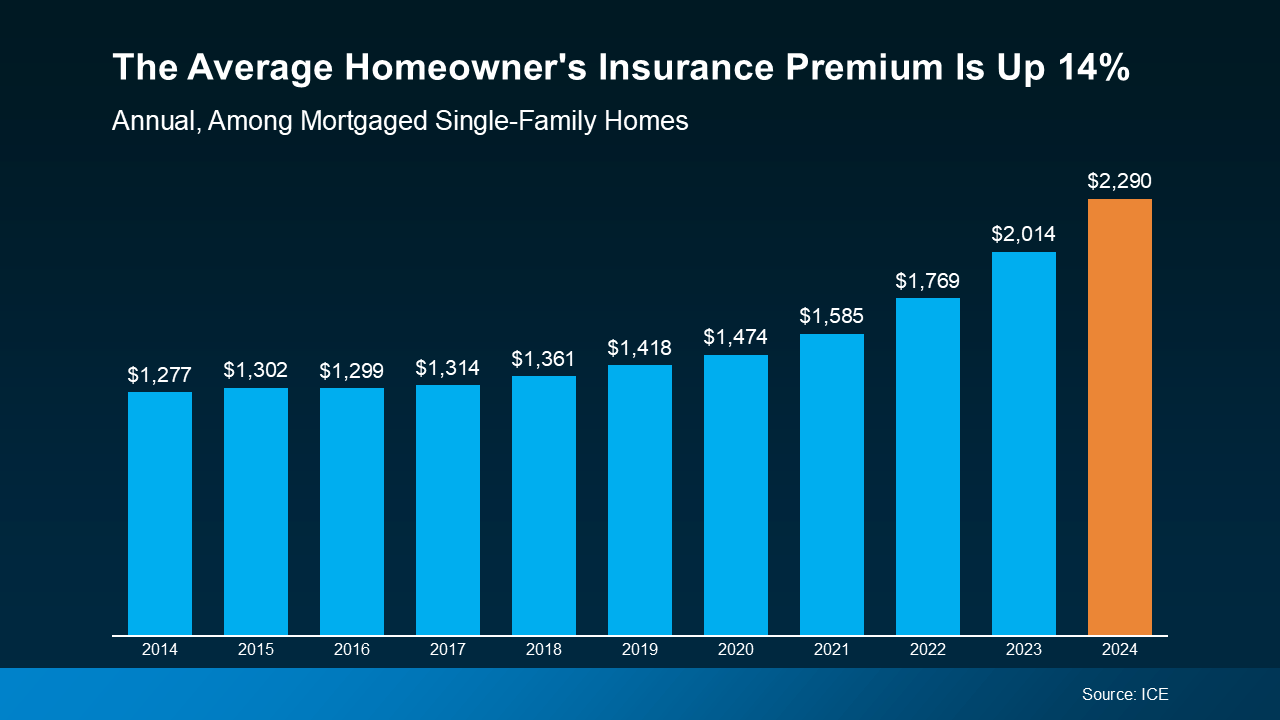

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

What’s your biggest concern when it comes to budgeting for homeownership? Talk to an agent to make sure you’re set up for success.

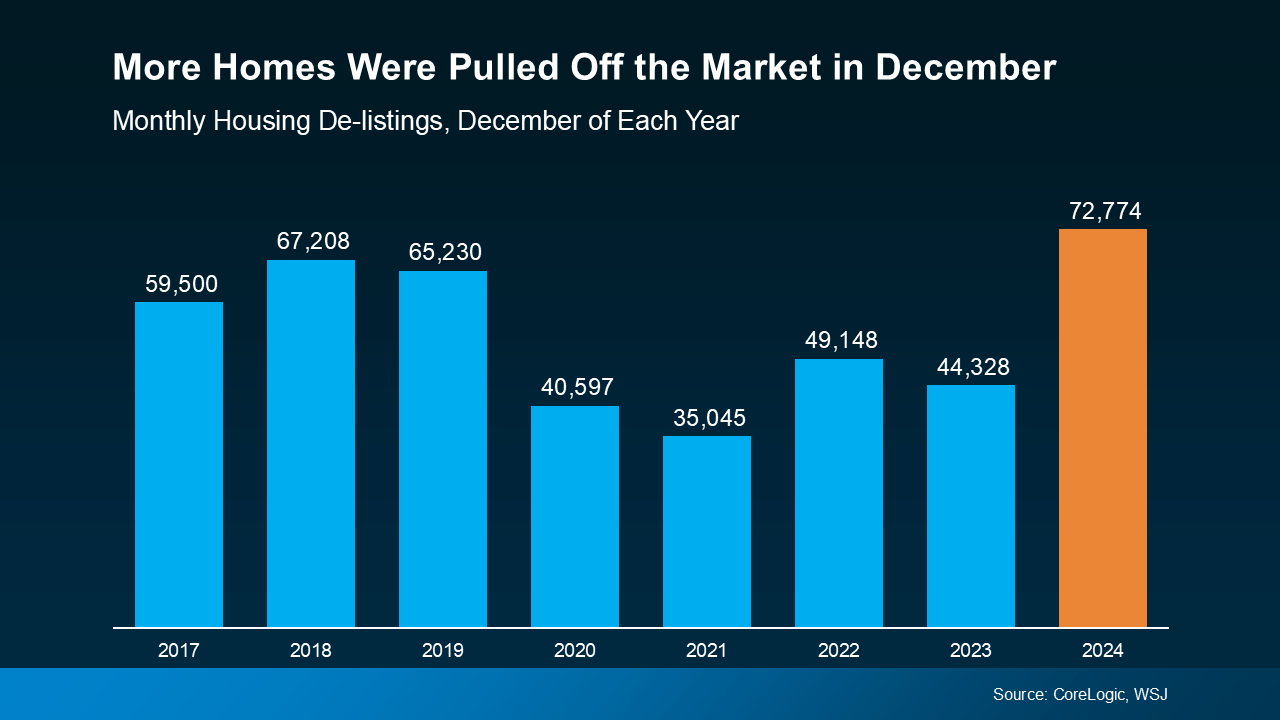

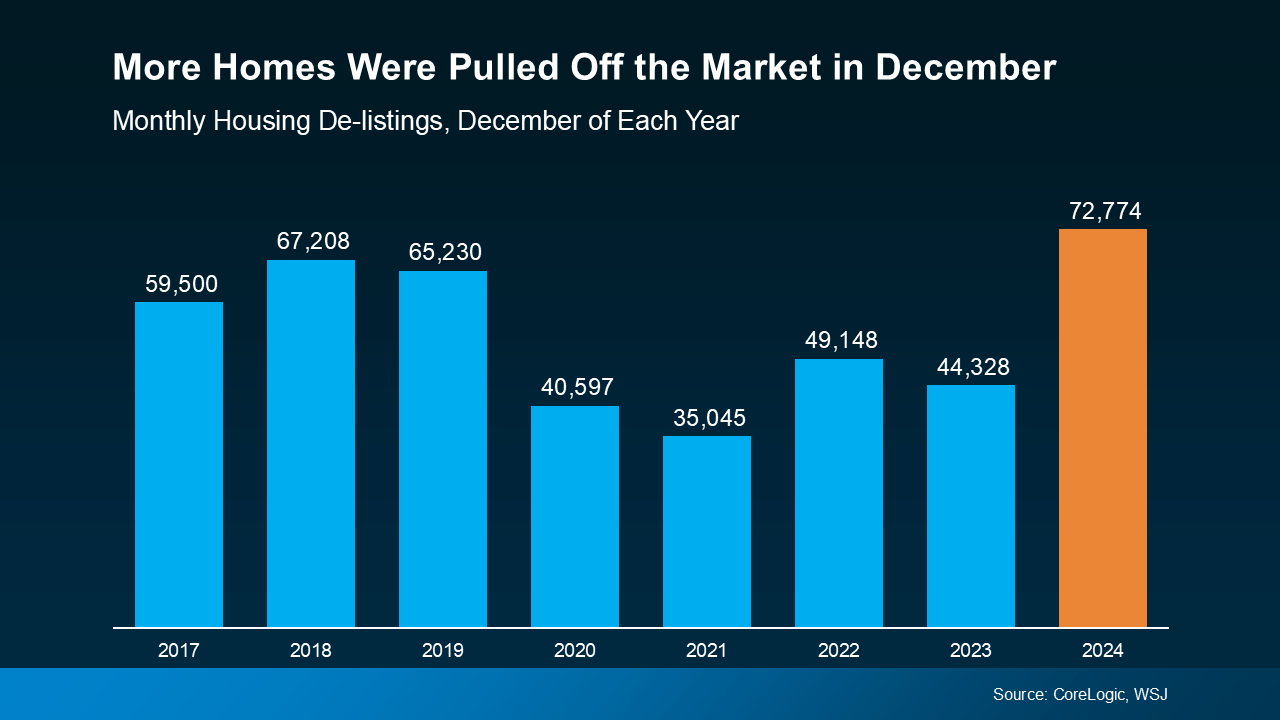

If you took your house off the market in late 2024, you’re not the only one. Newsweek reports that data from CoreLogic and the Wall Street Journal (WSJ) says nearly 73,000 homes were pulled from the market in December alone – that's more than any other December going all the way back to 2017 (see graph below):

Whether it was because offers weren’t coming in, the timing around the holidays felt overwhelming, or they wanted to see if the market would improve in the new year – a lot of other homeowners decided to press pause, too.

Whether it was because offers weren’t coming in, the timing around the holidays felt overwhelming, or they wanted to see if the market would improve in the new year – a lot of other homeowners decided to press pause, too.

But now, with spring fast approaching, it’s time to reassess. The market is already picking up, and waiting any longer to jump back in may only mean you’d face more competition from other sellers down the road.

Selma Hepp, Chief Economist at CoreLogic, explains that some of those sellers may have pulled their listings late last year with the goal of trying again this spring:

“Another reason for a step back could be that sellers wanted to wait and see how spring home buying season goes, and if mortgage rates fall, which would bring more home buyers and competition back in the market.”

That’s because spring is when buyer demand is typically at its highest point for the year. More people start their home search once the weather warms up. They’re eager to close on a home so they can move in during the summer. So, it’s a great window for sellers. It means more buyers.

And while mortgage rates haven’t fallen dramatically, they have come down some in recent weeks. Early signs already show buyers are becoming more active as a result. Since January, demand has picked up – and that should continue as spring draws even closer.

Start by checking the status of your listing agreement. Because even if you pulled your listing, you may still be under contract. And until your listing expires, your agent or brokerage is your best resource on what else you could try to get it sold. Realtor.com offers this advice:

“If you aren't sure of the status of your listing, whether active, expired, or withdrawn, take a look at your listing agreement and talk to your real estate agent.”

If your contract is still active, now’s the perfect time to reconnect with your agent to explore strategies to get your home sold this time around. If your contract has expired and you’re considering other options, reach out to a trusted real estate professional who can help you figure out where to go from here.

Either way, take some time to reflect on your last experience. What held you back from getting it sold before? And what can you do to improve your chances this time around?

Be sure to include your agent in this thought process. They’ll give you an objective point of view and some advice based on what may have gone wrong last time, like:

If your house didn’t sell last year, spring may be your second chance. With buyer activity rising, it’s the perfect time to talk to an agent about coming back into the market with a fresh strategy.

What do you want to do differently this time around? Talk to your agent to go over your options and make a plan.

If you took your house off the market in late 2024, you’re not the only one. Newsweek reports that data from CoreLogic and the Wall Street Journal (WSJ) says nearly 73,000 homes were pulled from the market in December alone – that's more than any other December going all the way back to 2017 (see graph below):

Whether it was because offers weren’t coming in, the timing around the holidays felt overwhelming, or they wanted to see if the market would improve in the new year – a lot of other homeowners decided to press pause, too.

Whether it was because offers weren’t coming in, the timing around the holidays felt overwhelming, or they wanted to see if the market would improve in the new year – a lot of other homeowners decided to press pause, too.

But now, with spring fast approaching, it’s time to reassess. The market is already picking up, and waiting any longer to jump back in may only mean you’d face more competition from other sellers down the road.

Selma Hepp, Chief Economist at CoreLogic, explains that some of those sellers may have pulled their listings late last year with the goal of trying again this spring:

“Another reason for a step back could be that sellers wanted to wait and see how spring home buying season goes, and if mortgage rates fall, which would bring more home buyers and competition back in the market.”

That’s because spring is when buyer demand is typically at its highest point for the year. More people start their home search once the weather warms up. They’re eager to close on a home so they can move in during the summer. So, it’s a great window for sellers. It means more buyers.

And while mortgage rates haven’t fallen dramatically, they have come down some in recent weeks. Early signs already show buyers are becoming more active as a result. Since January, demand has picked up – and that should continue as spring draws even closer.

Start by checking the status of your listing agreement. Because even if you pulled your listing, you may still be under contract. And until your listing expires, your agent or brokerage is your best resource on what else you could try to get it sold. Realtor.com offers this advice:

“If you aren't sure of the status of your listing, whether active, expired, or withdrawn, take a look at your listing agreement and talk to your real estate agent.”

If your contract is still active, now’s the perfect time to reconnect with your agent to explore strategies to get your home sold this time around. If your contract has since expired and you’re considering other options, reach out to a trusted real estate professional who can help you figure out where to go from here.

Either way, take some time to reflect on your last experience. What held you back from getting it sold before? And what can you do to improve your chances this time around?

Be sure to include your current agent in this thought process. They’ll give you an objective point of view and some advice based on what may have gone wrong last time, like:

If your house didn’t sell last year, spring may be your second chance. With buyer activity rising, it’s the perfect time to talk to an agent about coming back into the market with a fresh strategy.

What do you want to do differently this time around? Talk to your agent to go over your options and make a plan.

Want to know two reasons this spring might finally be your time to buy? Inventory has grown and sellers may be more willing to negotiate as a result. That means you’ve got more options and more power than buyers have had in years. Let’s break it down.

The number of homes for sale this February was higher than it’s been in any of the past five Februarys – and that’s great news for your home search. The graph below uses the latest data from Realtor.com to show the supply of homes on the market has grown by 27.5% in just the last year:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

More choices for your search is a good thing – and experts also say that inventory is projected to continue rising this year, which is even better. It means it should be easier to find something that checks your most important boxes. But that’s not all this does for you. Danielle Hale, Chief Economist at Realtor.com, explains some of the other perks of more inventory, beyond just having more homes to consider:

“Buyers will not only have more home options . . . but they are also likely to find somewhat lower asking prices and more time to make decisions – all buyer-friendly factors as we inch closer to the busy homebuying season.”

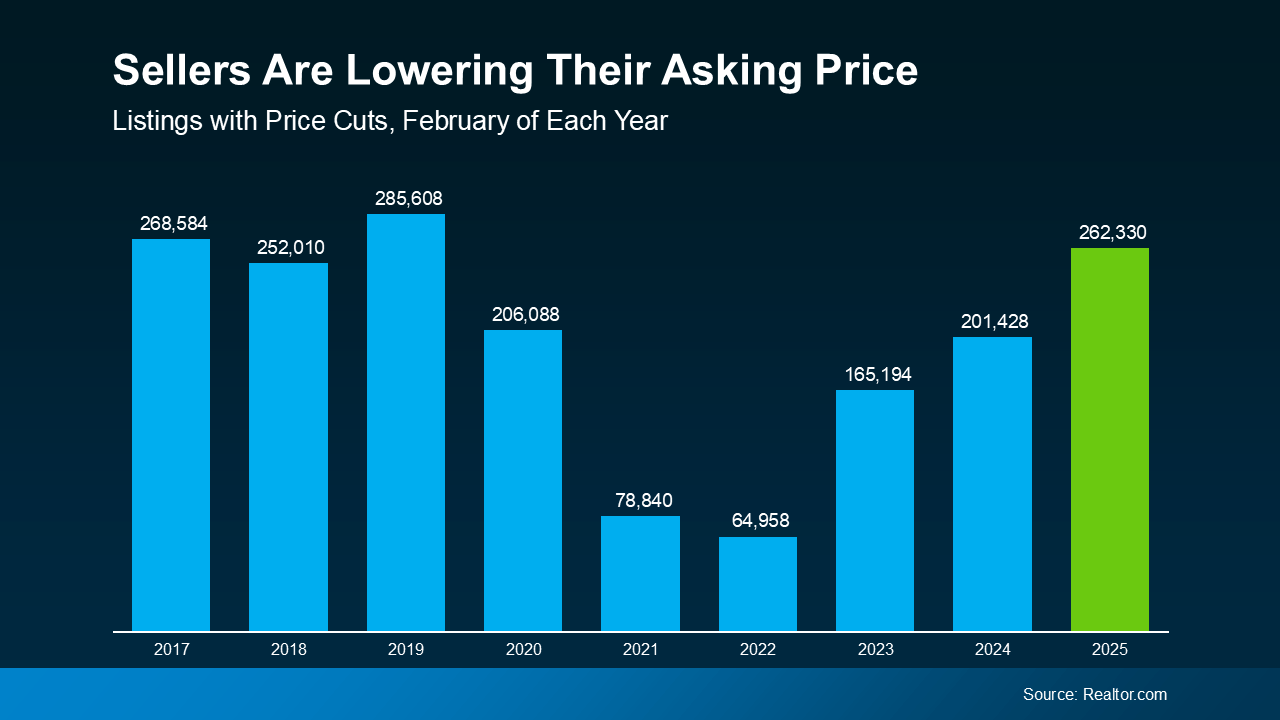

Now that buyers have more options, some homes are sitting on the market a little longer – especially those that were priced too high from the start. And the result is more sellers are having to drop their prices to draw buyers back in. Just take a look at the numbers.

According to Realtor.com, the number of listings with price reductions has gone up compared to the last few years (see graph below):

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

What does that mean for you? It could give you a better chance to negotiate – whether that’s on price, closing costs, or even repairs. While not every seller will adjust their price, more of them are willing to do it – giving you more leverage than buyers have in quite a while.

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Of course, every market is different, and working with a local expert can help you work through your options. If you want to talk about what’s happening in your area or get started on your home search, connect with a local real estate agent.

How does today’s rising inventory impact your homebuying plans?